About the Project

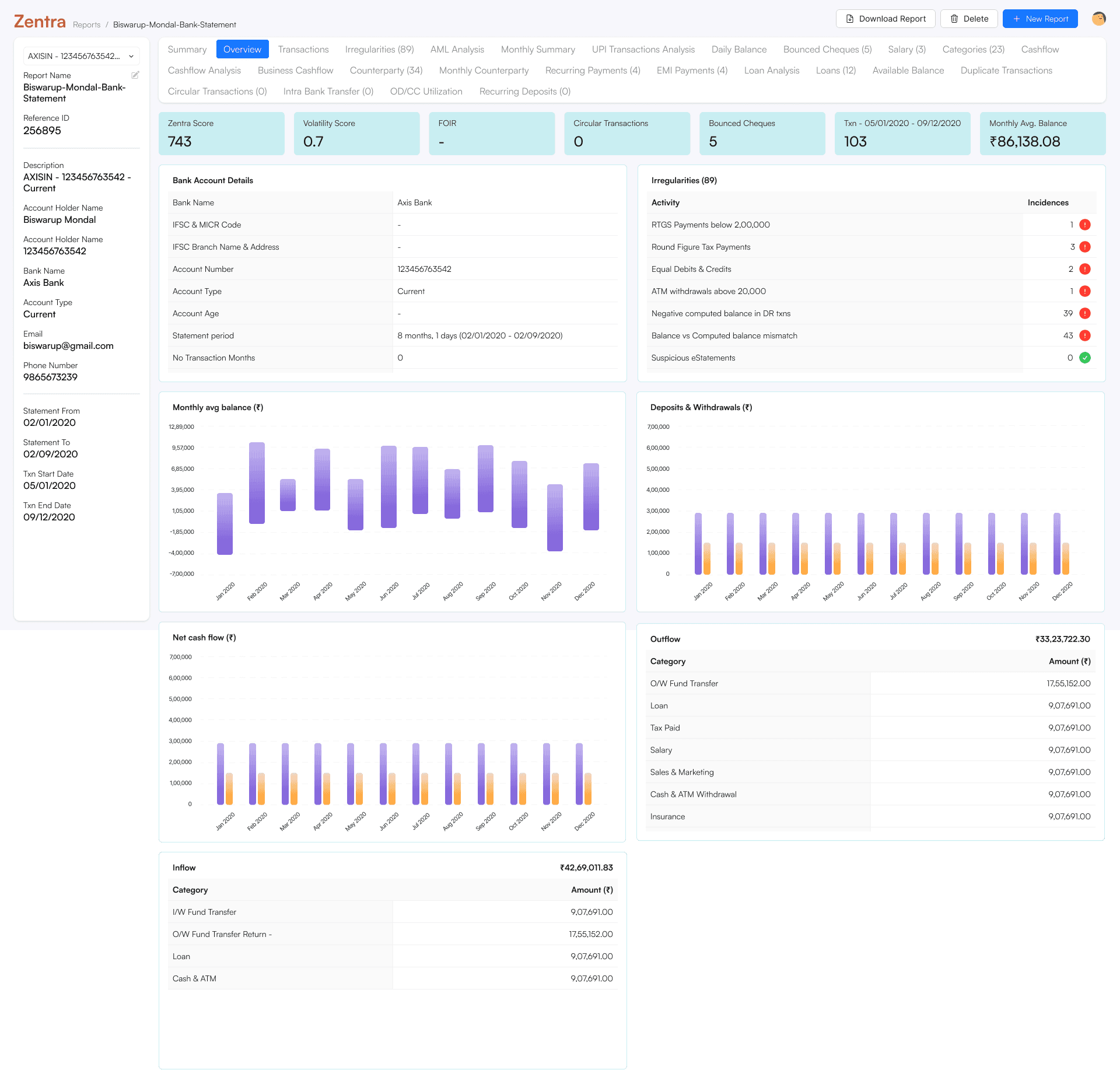

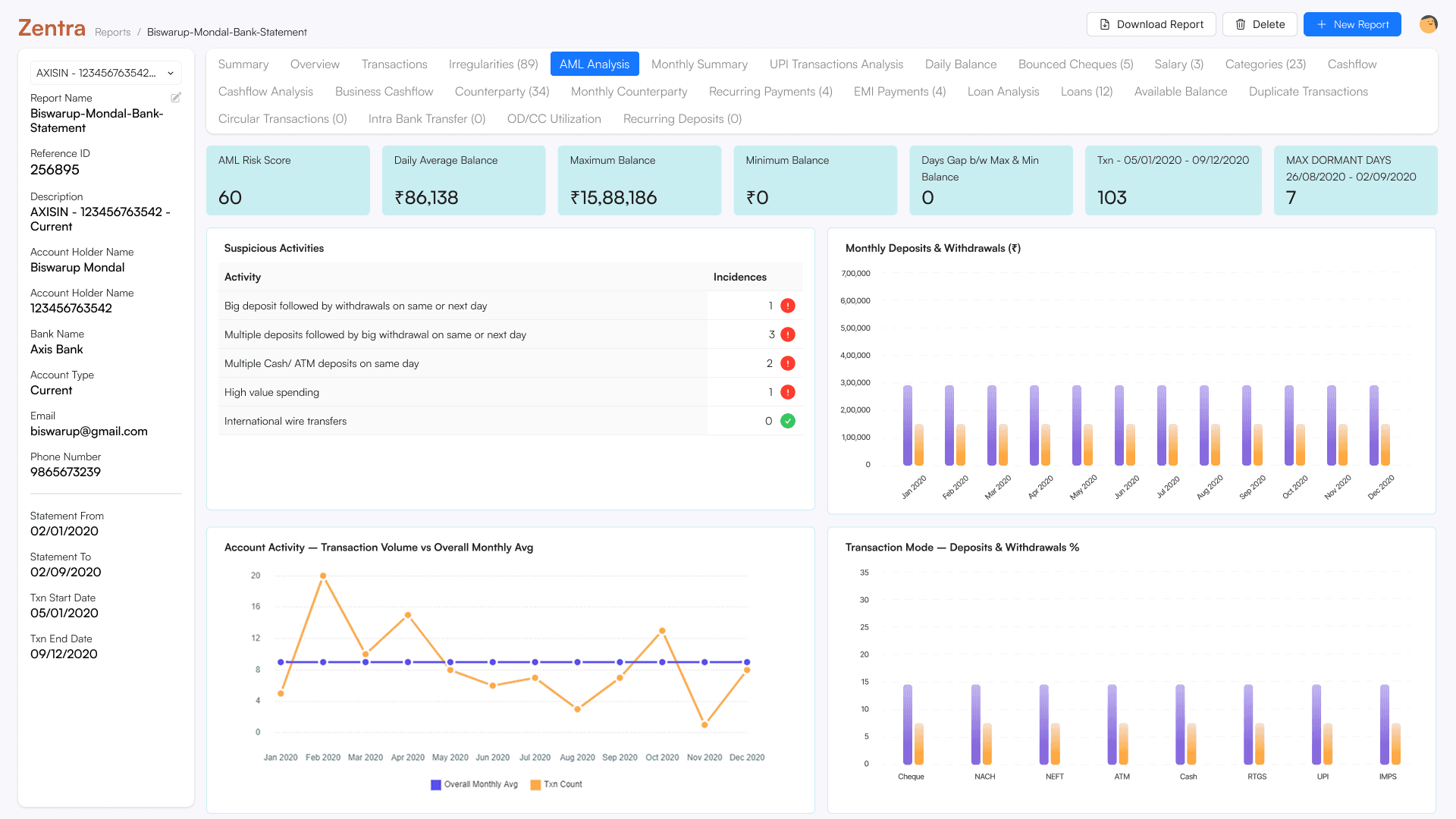

In the high-stakes world of lending, speed and accuracy are paramount. Zentra is an intelligent Bank Statement Analyser designed for financial institutions to automate and accelerate the traditionally manual and error-prone process of reviewing bank statements.

Built for credit analysts, underwriters, and loan officers, Zentra transforms complex financial data into clear, actionable insights—empowering professionals to make faster, data-driven lending decisions.

Impact Highlights:

70% reduction in loan approval time

60% less time spent on manual data checks

35% increase in customer satisfaction for early adopters

As the Lead Product Designer, I owned the end-to-end design process, including product strategy, UX research, user interface design, prototyping, and testing.

Problem Statement

Zentra was designed to solve three core problems faced by financial institutions:

Manual Workload: Credit analysts were spending hours per applicant manually reading and summarizing bank statements.

Error-Prone Assessments: Human errors and missed details were leading to flawed assessments and delayed approvals.

Operational Inefficiency: Institutions struggled to scale lending operations without significantly increasing headcount.

By automating data extraction, contextual analysis, and financial summaries, Zentra enables:

Rapid loan approvals

More consistent and defensible lending decisions

Better allocation of human expertise toward complex, high-value cases

What Problem Does It Solve?

Loan processing in many financial institutions remains manual, inconsistent, and time-consuming. Credit analysts are required to parse through dozens of pages of bank statements to identify cash flows, anomalies, spending patterns, and red flags—often under tight deadlines.

Despite technological advances, many banks still rely on outdated systems or generic PDF parsers that fail to deliver the contextual understanding necessary for lending risk assessment.

Product Vision & Strategy

Vision

To become the decision intelligence layer for lending teams, by transforming raw financial data into clarity, confidence, and speed.

Zentra is not just a data parser; it's a decision-making companion. Our vision was to make financial analysis fast, reliable, and insightful—so institutions could scale their operations while delivering better customer experiences.

Strategy Highlights:

User-Centered Design: Grounded in empathy for credit analysts and underwriters—our primary users.

System Thinking: We mapped the entire loan approval pipeline to identify choke points, not just UI-level fixes.

Design for Trust: In a domain where risk is high, the UI needed to feel intelligent, professional, and auditable.

Business Alignment: Ensured that every feature aligned with measurable business goals like time-to-approval and customer satisfaction.

How I Solved the Problem

Stakeholder Interviews

Key pain points:

Recurring income is hard to spot in messy statements.

No standard format across banks.

Red flags are often missed.

A competitive audit revealed most tools extract data—but don’t interpret or summarize it.

Persona Definition

Meera (Risk Officer, 41): Seeks consistency and auditability for compliance.

Vikram (Loan Manager, 39): Prioritizes team efficiency and insight visibility.

Ravi (Credit Analyst, 34): Needs quick, accurate summaries under pressure.

Solution Highlights

Anomaly Detection: Confidence-based outlier spotting.

Natural Language Summaries: Clear financial narratives, not just raw tables.

Red Flag Alerts: Real-time detection of risk indicators (e.g. overdrafts)

Automated Categorization: ML-based tagging of income, expenses, and patterns.

Design Execution

Designed wireframes & high-fidelity prototypes in Figma.

Built a scalable design system for reusability.

Followed accessibility best practices for clarity and compliance.

Reflection

What I Learned:

Designing for trust is more than aesthetics—it’s about transparency, consistency, and user control.

In enterprise fintech, clarity beats cleverness. Users valued functional, explainable interfaces over flashy interactions.

Cross-functional alignment (with data science, engineering, and compliance) was critical for feature prioritization.

What I’d Do Differently:

Integrate real-time collaborative features for teams reviewing the same file.

Involve legal/compliance teams earlier to preempt late-stage pivots.

Personal Growth:

Zentra was a milestone in owning a strategic, high-stakes product from zero to launch. It honed my skills in:

Enterprise UX

Systems thinking

Stakeholder collaboration

Bridging product strategy with precise, user-focused design